Property Tax Rate In Nassau County Fl . the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on a median home value. Search the nassau county interactive gis maps & spatial data. search for properties located within nassau county. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. the average property tax rate in florida is around 0.98%, which places nassau county slightly above average.

from zippboxx.com

the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on a median home value. Search the nassau county interactive gis maps & spatial data. the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. search for properties located within nassau county. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county.

Nassau County Property Tax 🎯 2022 Ultimate Guide to Nassau Property

Property Tax Rate In Nassau County Fl the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. Search the nassau county interactive gis maps & spatial data. search for properties located within nassau county. the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on a median home value.

From www.zillow.com

The Highest and Lowest Property Taxes in Florida Zillow Porchlight Property Tax Rate In Nassau County Fl the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. search for properties located. Property Tax Rate In Nassau County Fl.

From www.slideserve.com

PPT A Comprehensive Guide to Nassau County Property Taxes PowerPoint Property Tax Rate In Nassau County Fl the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. Search the nassau county interactive gis maps & spatial data. search for properties located within nassau county. the average. Property Tax Rate In Nassau County Fl.

From www.slideserve.com

PPT Navigating Nassau County Property Tax PowerPoint Presentation Property Tax Rate In Nassau County Fl Search the nassau county interactive gis maps & spatial data. the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. search for properties located within nassau county. the. Property Tax Rate In Nassau County Fl.

From www.slideserve.com

PPT The Impact of Property Values on Nassau County Tax Bills Property Tax Rate In Nassau County Fl the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. search for properties located. Property Tax Rate In Nassau County Fl.

From bellmorelibrary.assabetinteractive.com

07/31/2023 Nassau County Property Tax Exemptions Bellmore Property Tax Rate In Nassau County Fl search for properties located within nassau county. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. the average property tax rate in florida is around 0.98%, which places. Property Tax Rate In Nassau County Fl.

From tooyul.blogspot.com

File Property Tax Grievance Nassau County Tooyul Adventure Property Tax Rate In Nassau County Fl the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. . Property Tax Rate In Nassau County Fl.

From breeazmariele.pages.dev

Florida Sales Tax Schedule 2024 Inna Renata Property Tax Rate In Nassau County Fl the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on a median home value. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. the nassau county board of county commissioners presented a tentative $488.4 million budget and a. Property Tax Rate In Nassau County Fl.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Property Tax Rate In Nassau County Fl the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. search for properties located within nassau county. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. Search the nassau county interactive gis maps & spatial data. the. Property Tax Rate In Nassau County Fl.

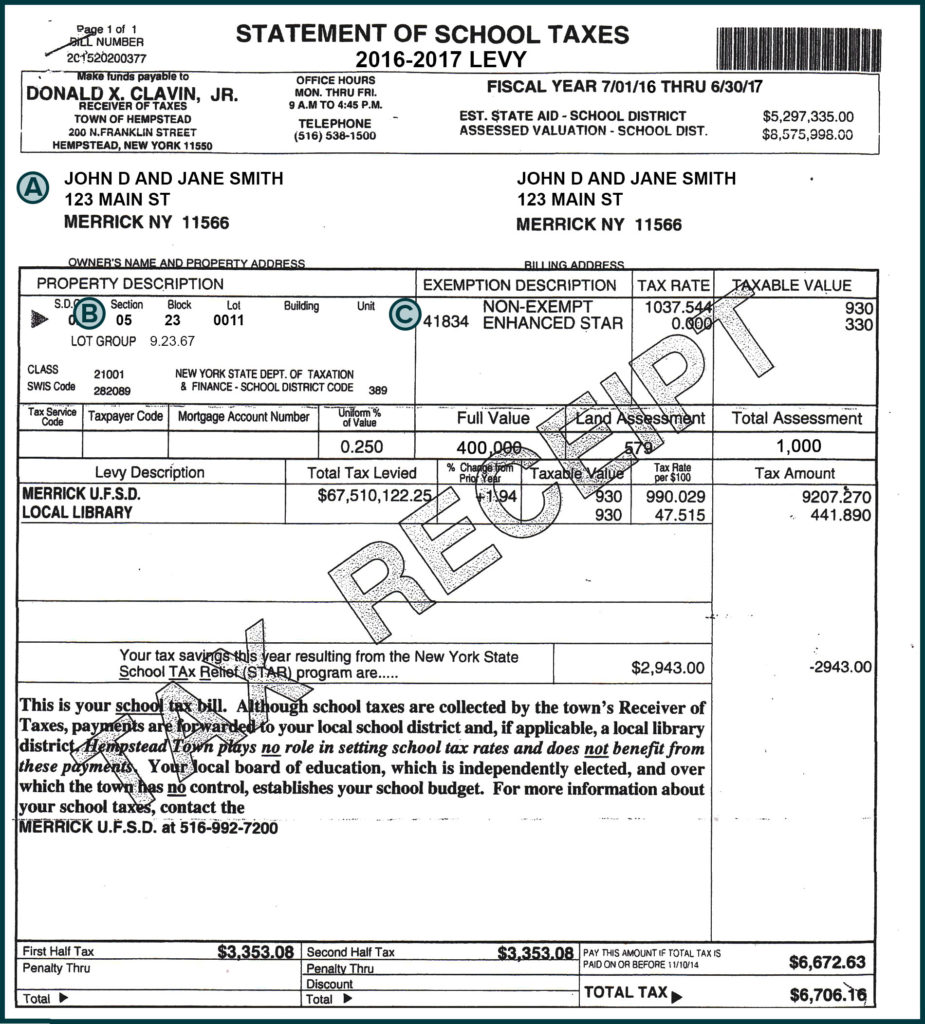

From www.tax.ny.gov

Property tax bill examples Property Tax Rate In Nassau County Fl the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. . Property Tax Rate In Nassau County Fl.

From www.slideserve.com

PPT Understanding Nassau County Property Tax System PowerPoint Property Tax Rate In Nassau County Fl the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on a median home value. search for properties located within nassau county. Search the nassau county interactive gis maps & spatial data.. Property Tax Rate In Nassau County Fl.

From www.floridaforboomers.com

10 Highest (and Lowest) Florida County Property Taxes Florida for Boomers Property Tax Rate In Nassau County Fl the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on a median home value. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by. Property Tax Rate In Nassau County Fl.

From marinrinaldi.blogspot.com

nassau county property tax rate 2021 Marin Rinaldi Property Tax Rate In Nassau County Fl the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on. Property Tax Rate In Nassau County Fl.

From www.propertytaxreductionguru.com

Property Tax Reduction Specialists in Nassau County Property Tax Property Tax Rate In Nassau County Fl the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. the median property tax. Property Tax Rate In Nassau County Fl.

From www.pdffiller.com

County Nassau Transfer Tax Fill Online, Printable, Fillable, Blank Property Tax Rate In Nassau County Fl Search the nassau county interactive gis maps & spatial data. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. search for properties located within nassau county. the median. Property Tax Rate In Nassau County Fl.

From www.slideserve.com

PPT A Comprehensive Guide to Nassau County Property Taxes PowerPoint Property Tax Rate In Nassau County Fl the nassau county board of county commissioners presented a tentative $488.4 million budget and a maximum. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of. Search the nassau county interactive gis maps & spatial data. search for properties located within nassau county. the median. Property Tax Rate In Nassau County Fl.

From prorfety.blogspot.com

Nassau County Property Tax Questions PRORFETY Property Tax Rate In Nassau County Fl the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on a median home value. search for properties located within nassau county. Search the nassau county interactive gis maps & spatial data. The tax collector has the authority and obligation to collect all taxes as shown on the tax roll. Property Tax Rate In Nassau County Fl.

From www.armstrongeconomics.com

US Property Tax Comparison By State Armstrong Economics Property Tax Rate In Nassau County Fl search for properties located within nassau county. the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. the tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. The tax collector has the authority and obligation to collect all taxes as shown. Property Tax Rate In Nassau County Fl.

From exozpurop.blob.core.windows.net

Property Tax Differences Between States at Alfredo Nowak blog Property Tax Rate In Nassau County Fl the average property tax rate in florida is around 0.98%, which places nassau county slightly above average. the median property tax (also known as real estate tax) in nassau county is $1,572.00 per year, based on a median home value. search for properties located within nassau county. the nassau county board of county commissioners presented a. Property Tax Rate In Nassau County Fl.